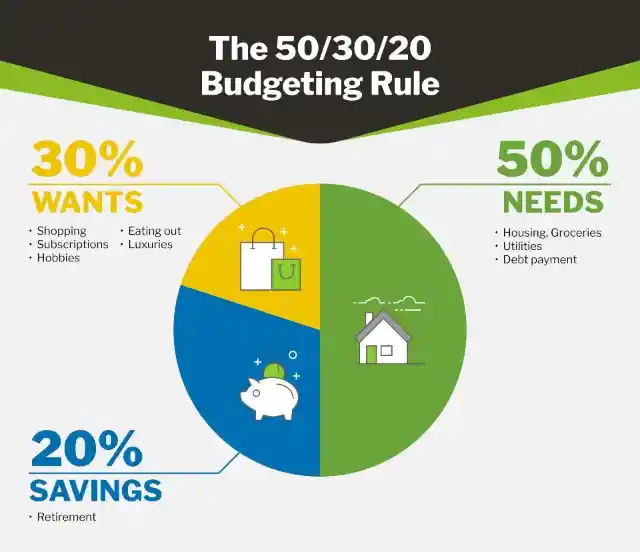

The 50/30/20 Budget

When it comes to budgeting, you have plenty of options. You can use a spreadsheet or app or simply keep track of your spending on paper. But one smart way to manage your money — and hopefully hold on to more of it — is to follow a budget, which means setting priorities for your spending.

The 50/30/20 budget is an excellent guide that helps allocate your dollars. The main idea is to devote 50% of the take-home to your needs, leaving 30% to wants and 20% to savings. This rule can be adjusted depending on what works best for you.

Give Extra Income A Good Use

If you are one of those lucky guys who gets extra money (lottery, inheritance, tax refund, work bonus, and so on!), you should wisely consider how you’re gonna use it. This unexpected income may be a one-time thing, so think before screwing it up.

If you can, save it all. It’s the best use you can give to the money. However, not everything in life is about saving. Give that money a good use and treat yourself to that trip you have always dreamed about. Time’s now!

Bye Bye, Debts!

The best thing you can do when you get extra money is to pay off any debt or balance that’s due. Student loans, credit card balances, or any other debt is better to pay it off now and get rid of it as soon as possible.

No matter how young you’re, you should always consider having an emergency fund. Anything can happen to you, and you have to be economically ready. Using the extra money to build up an emergency fund is the wisest thing you can do after you pay your debts.

Set Realistic Goals

Setting a savings goal is the first step to getting your finances in order. It’s also a great way to get motivated and stay on track with your savings efforts. A savings goal can be as simple as “save $1,000 by December 31” or as complex as “pay off my student loans in 10 years.”

The key is to set a specific but realistic goal that you feel passionate about achieving. Get excited about it! Think about what you could do with that money once it is saved. That should help keep you motivated when things get tough, and temptations abound.

Snowball Method

As hard as it may sound, debt is the first thing you should avoid to lower your monthly costs. Try to stay away from it as much as you can. Monthly debt payments only steal money from your income.

The best way to get rid of debt is with the snowball method. This process dictates to start paying debts from the smallest ones to the largest. Once you’ve tried this, your monthly income will have much more weight.

Choose Generic Brands

Living in a world with famous brands is quite challenging to resist. There’s no difference between buying Adidas sandals or just a generic sandal. Both fulfill the same purpose, but only one is way too expensive.

The purpose here is to try to save as much money as possible, so avoid buying brand-name products and aim at generic ones. This tip applies not only to clothing but also to medicine, staple food and cleaning items –and practically every item you can find in the supermarket.

Morning Coffee Run

There’s nothing better than starting your week –or your morning routine– with a fresh cup of coffee from your favorite coffee shop. You probably don’t want to hear it, but you should: you have to cut down on your daily coffee run.

Think about it. Each latte costs around $5, which sums up to approximately $100 to $150 a month. Find alternative ways to spend less and get the same quality of coffee. You can buy a bag of local beans from your favorite coffee store and brew it at home.

Automate Your Savings

Money that you don’t see is money that you can’t spend. Keep this in mind. Nowadays, banks include in their settings a handy option that will make you save money automatically.

You can have funds transferred to a savings account monthly after every paycheck. You can also set up to transfer a percentage of funds. It’s up to you! The best part is that you don’t have to worry about saving money. You can easily automate it.

Subscriptions And Memberships

You might probably be paying subscriptions like Youtube and Netflix, not to mention gym memberships. Those are monthly expenses that you should get immediately rid of, especially if you don’t use them regularly.

It’s hard to decide what’s necessary and what’s not. For a start, you should choose one or two platforms to watch series and movies, not more than that. Do you listen to music on a regular basis? If you don’t, you can get rid of Spotify.

Membership Hack

Understandably, you don’t wish to lose your subscriptions and memberships. Maybe you give them good use and don’t want to stop having that access. In that case, you can share memberships with friends and family.

Most streaming services have a couple of profiles for the same account, like Netflix and Amazon Prime, so you can share it with someone, and each has its own profile linked on their devices. With this hack, you can keep your favorite platforms at a low cost.

Cut Down On Energy

Working from home is the best thing ever happening to most people, except when the electric bill arrives. Now that you are at home all day long, using the computer, turning on the lights and other electric devices, you’d better learn how to save money on your next electric bill.

It’s very simple! Start by changing to LED lightbulbs. Consider taking shorter showers and washing clothes in cold tap water. Indeed, energy-efficient appliances aren’t affordable, but you’ll save money on your electric bill over time.

Marketing Emails Are Tempting

That’s what marketers do for a living. They try to convince people to spend money on the product or service they market. There will always be an irresistible offer in your mailbox, so you’d better unsubscribe.

If you are one of those who can’t resist special offers, you should consider unsubscribing. To unsubscribe, you just have to go down to the bottom of the email and click the unsubscribe link. Do this, and you won’t be tempted to spend unnecessary money every time you get an email.

Meal Plan

Strategic buying is the best way to save money. If you plan your meals, you’ll save lots of money on grocery shopping. You just have to anticipate what you’re going to eat and what you have already in storage.

Another great hack is to pay attention to the store’s discount days. You’ll save tons of money on essential items if you attend on those days. It’s all about planning your expenses wisely and prioritizing your must-haves.

Homemade Meals

It’s easy to get business lunches out of hand. Not to mention grabbing a coffee every morning before work. Let’s be honest—who really wants to pack a lunch when there are so many delicious choices right outside your office?

What’s the point of having a kitchen if you don’t properly use it? Prepare your coffee at home, pack a lunch, avoid going out for dinner, and save yourself a few hundred bucks and some calories.

Reduce Your Cell Phone Plan

Your wireless plan is probably costing you more than you realize. Many people choose their plan based on the number of minutes they need rather than on how much data they actually use.

If you have an unused allotment of minutes or texts each month, consider switching to a lower-cost plan with fewer bundled minutes and texts. You may end up saving money every month without noticing any difference in service quality or coverage areas for voice calls and texts.

Pick Up / Delivery

Getting to the mall is nothing but a temptation to buy more items than you really need. The so-called “quick run” is never quick nor a run. Nowadays, you can easily dodge this temptation by ordering online. The best part is that you can pick your order up or get it delivered.

By ordering online, you force yourself to buy what’s important and necessary. You’ll avoid getting lost in the aisles and spending money you could’ve saved.

Spending Freeze

A spending freeze is exactly what it sounds like: You stop spending money on nonessential items. The idea is that you don’t buy anything new. It might sound drastic, but it’s actually relatively easy to do if you make the suitable preparations ahead of time.

To start, prep meals with the food you already have in the fridge. You don’t need to run to Target if you don’t have an ingredient. Instead, find a way to replace it with something you do have!

Keep Track Of Everything

You likely know what you're spending and saving each month. But if you want to be sure you hit your savings goal, it's an excellent idea to keep track of your monthly cash flow — your income minus your expenditures.

You’re making money but not saving enough. To fix that, you need to know where your money goes. Write down everything you spend money on each day. You can also download a budget app to track each penny you spend.

Limit Your Cards

You likely lose track of how much money you spend with debit and credit cards. The best way to avoid unnecessary spending is to put a cap on your cards. This way is the fastest one to save money.

If you want to save money, you have to manage it wisely. You can set daily spending limits and whether you can withdraw money or not. It’s not easy to implement, but it can help you reconsider your expenditures.

DIY Is Not Only a Trend

You can find hundreds and millions of DIY videos on the Internet about any topic you like. These videos are not just a trend but an excellent way to save money! You just need the materials and be autodidactic with your Google or Youtube search.

Sometimes these DIY videos aren’t as easy as they seem. You can ask a friend or a relative to help you out with your project. You can spend some time together and have fun working on it!

Cable TV

Paying over $2,000 yearly for cable TV sounds like a waste of money. You are missing the point if you want to keep it for the weather forecast and news. Thanks to the Internet, you can find the latest information you need. So why keep having cable TV?

There are indeed great shows on TV these days… but you can watch plenty of shows on a streaming platform of your choice, which is cheaper because you get to share it with someone else!

Libraries Do Exist!

Libraries aren’t a thing of the past. Instead of spending money on a book that you will read and then leaving it behind with no other use, you can check on your nearest library to see if you can borrow it! There are hundreds of buildings that pile up books of your choice.

Nowadays, libraries have audiobooks and digital copies. There are hundreds of affordable choices at hand! Next time you want to read something, try these zero-cost options and save some bucks!

Be Creative With Gifts

You don’t need to spend hundreds of dollars on luxurious gifts. Your friends and family will value it more if you make a gift just for them. Think about what the person likes most and create something accordingly.

There are plenty of affordable gifts out there. Baking a cake or cookies or giving out a plant are cheap and easy-to-make examples. You just have to be creative and have some fun in the process!

Staycation Every Now And Then

You might think that staying close to home for vacation would be boring compared to traveling abroad or even just driving farther away from where you live — but that's not necessarily true!

There are plenty of things to do at home, even if you've got limited funds for travel expenses, such as visiting museums and parks or getting outdoors for hiking or camping trips with friends. You just have to search a little bit to become a tourist in your own city.

Sell Everything You Can

Just like Marie Kondo will do, start getting rid of material things that you don’t use anymore. Some items are of great value, and you can sell them. Make some extra cash by selling what you don’t need or doesn’t bring you joy anymore.

The best part is that there are a ton of different places where you can sell your stuff online, from Craigslist and eBay to Facebook Marketplace and Letgo. If those options aren’t available where you live, try asking friends if they know anyone interested in buying some things from their homes too!

Learn To Fix Things By Yourself

Nowadays, many Youtube videos show how to fix broken stuff. Instead of calling someone who will charge you hundreds of dollars, try fixing things by yourself. You just have to be patient and open to learning new things.

The very least you can do is try. You can ask a relative or a friend for help if you try and fail. Calling an expert should be the last thing to do. Try to exhaust all options before paying someone to fix it for you.

Keep The Change

If you had a dollar for every time you said “keep the change,” you’d have your saving pig about to explode. Seriously, keeping the change and saving every penny can become a lot of money after a couple of years.

Putting aside at least 50 cents a day can make the difference. These savings can work as an emergency fund or money you can spend on your vacation. The choice is yours!

Grocery Shopping

Buy smart when you go grocery shopping. Avoid expensive and unnecessary items that will eventually sum up in the total amount. The little purchases are the worst ones and the most difficult to spot.

Yes, we all want unhealthy snacks like cookies and chips, but most are expensive and somewhat unnecessary. It’s simple: discipline now or regret it later! By the end of the month, you’ll realize how much you’ve saved.

Ask For Discounts

While it’s easy to assume that a discount will never be offered, you never know until you ask. Ask if there are any other discounts available and if they would be willing to give one to you. Sometimes they’ll just say no, but don’t be afraid to ask.

You can also try asking about an online coupon code or special offer to get your savings back up to par with what other people are getting. Most businesses want customers back and will be willing to give you a special gift if it means you’ll be back!

Cash-Back Apps

Try cash back apps if you find coupons an excellent deal to save money! They help you save even more money. Ibotta is an easy way to get cash back on items you buy every day. When you shop at participating stores and scan items in their app, Ibotta will give you cash back.

Rakuten is another cash-back app that can help you save money on everyday purchases. It’s free to use and offers immediate savings on all products, including groceries, pharmacy items, household goods, pet supplies and more.