#20. The Beginning Of Entrepreneurship

Ever since entrepreneurship began, many men and women have managed to transform a small capital into huge projects that turned out to become several times bigger than the initial investments.

And if you want to learn about investments, we must check out the biggest players and use some of their techniques to help us thrive, right?

#19. Stock Market Goals

Some of the ways to become a rich person are to invest in the stock market. However, it all comes with a lot of investigation, patience, and research.

You cannot rely on good luck, and you must think in long-term goals, you must know you are taking risks, you must control your emotions and make logical decisions, and (of course) know all the basics about the stock market.

#18. Warren Buffett

A name often heard across the globe is Warren Buffett, the most successful investor in history. He started out with a very small amount of money, and now he has almost $85 billion.

His advice is very important for any investors that get lucky to get it. Mr. Buffett constantly appeared in all types of financial publications. Here's more about him at #12.

#17. ‘Jack’ Bogle John

Another legend is John “Jack” Bogle, who founded a company called The Vanguard Group. Many Americans know the company to be the source of low-cost mutual fund investments.

Nonetheless, John “Jack” Bogle is more famous than that, with Fortune magazine calling him in 1999 to be one of the “four investment giants of the 20th century.” And that’s not even all about him…

#16. The Intelligent Investor

John “Jack” Bogle even wrote a book called “Common Sense on Mutual Funds: New Imperatives for the Intelligent Investor,” which is a classic must-read book in the investment community.

He founded the Vanguard Investment Trust and made it available to the general public back in 1976. Here’s a statue of the legend in the next photo.

#15. Jack Bogle's Statue

In 2017, Warren Buffett’s annual letter to Berkshire Hathaway investors included an impressive statement about Jack Bogle, saying the following.

“If a statue is ever erected to honor the person who has done the most for American investors, the hands-down choice should be Jack Bogle.” And yes, that’s his bronze statue in the Vanguard campus.

#14. The Genius G. Weiss

This legendary investor has used the name G. Weiss for almost a decade and followed a single principle of investing to generate more profit: dividend yield.

Weiss bought stocks when they were within 1-% of their dividend yield to unload them when they got within 10% of their lowest. This technique made this investor very famous. Can you tell us their full name?

#13. Geraldine Weiss

It’s refreshing to see that the investing world has a woman in the boy’s club, right? Geraldine Weiss only revealed that she was a woman almost ten years after she became an investor because her work has been initially rejected.

She is now known as the “Queen of Blue-Chip Dividends.” Check out “the King of Bonds” at #7!

#12. Warren Buffett's Lessons

We talked in the beginning about this legendary investor who makes the front pages of Forbes and Business Insider, and that’s for a good reason.

He leads Berkshire Hathaway, and with just a simple comment, he can make markets move in the desired direction. He’s a person you’d want to pay attention in class!

#11. Peter Lynch

The most famous investor known to have played it safe is Peter Lynch and the index funds that became solid investments over the years.

The &P500 Index was the perfect opportunity for Peter Lynch and other investors to generate better returns. Here’s his famous phrase at #2 that is now a number one rule in investing.

#10. Charlie Munger

Charlie Munger is the Vice Chairman of Berkshire Hathaway, the 8th-largest private employer in the US. Warren Buffett, the organizations’ CEO, has described Munger as his partner.

The latter was also a successful chairman of the Wesco Financial Corporation (1984 to 2011). He was also mentored by Benjamin Graham, known to be the “Father of Modern Investing”.

#9. The Philanthropist

Charlie Munger’s fame in the investing community is also due to his philanthropic efforts. He has donated hundreds of millions to universities in the USA, to both private and public institutions.

His strategy was to invest in high-quality companies that had products or services he believed in.

#8. Jim Rogers

The co-founder of the Quantum Fund, Rogers was right when he predicted the supercycle at the end of the 1990s. Today, he recommended focusing not on oil but on gold and silver, which are “going through the roof.”

He also predicts that China will dominate the world economy, so he moved in 2007 to Singapore with his family to learn Chinese.

#7. Bill Gross

We’ve talked about the “Queen of Blue-Chip Dividends,” so we’re not going to forget about “the King of Bonds,” are we? Bill Gross has had quite a success in fixed-income investments leading to him becoming one of the best investors in history.

He started out with a small investment management company called PIMCO, which now has $1.77 trillion in assets under management.

#6. Benjamin Graham

The “Father of Modern Investing,” Benjamin Graham was Warren Buffett’s mentor and the investor that came up with the concept of “value investing.”

He concluded that we should buy securities when underpriced to have a huge profit when they become fully-realized. Here are some of the most important texts you must read…

#5. Security Analysis And The Intelligent Investor

Graham’s texts any investor should read are Security Analysis and The Intelligent Investor, which focus on issues like investor psychology, activist investing, concentrated diversification, and minimal debt.

Some of his successful students were Buffett, Irving Kahn, Walter J. Schloss, and William J. Ruane. Now let’s check out China’s biggest investor…

#4. Hui Ka Yan

China’s richest man in 2017, Hui Ka Yan is the chairman and largest shareholder of China Evergrande Group – worth more than USD 30 billion.

The Chinese property developer has completed more than 500 projects in 180 Chinese cities – having both residential and office projects.

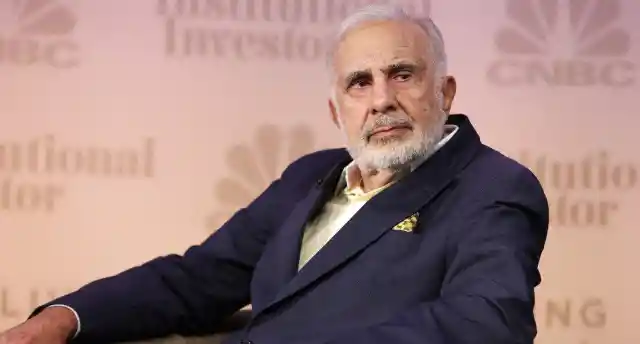

#3. Carl Ichahn

The corporate raider, Carl Icahn built his reputation by infiltrating a mismanaged company’s board of directors after purchasing enough shares until he got voting power.

He then rearranged the organization to make it more profitable or to strip the assets, just like he did with the American Airline TWA in the 80s. Last year, he was the 26th richest person in Forbes 400.

#2. Peter Lynch’s Famous Phrase

This legendary investor coined the famous phrase “invest in what you know.” Does it ring a bell?

He is known to have managed the Fidelity Magellan fund, achieving over double the index’s yearly returns, lifting the organization’s assets from a value of $18 million to $14 billion!

#1. Bill Miller

Mr. Miller’s best known for having a track record. For 15 years (1991 – 2005) he has beaten the S&P500’s yearly return with his Legg Mason Value Trust.

In 1999, Morningstar.com called him the “Fund Manager of the Decade.” He grew his fund from $750 million to more than $20 billion assets under management.